⇩ Use your ears. Click below to hear this post.

Maduro’s new Petro token is consolidating power and crowdfunding oppression.

“Imaginary evil is romantic and varied; real evil is gloomy, monotonous, barren, boring. Imaginary good is boring; real good is always new, marvelous, intoxicating.”

― Simone Weil

Last year, token sales raised approximately $5.6 billion. The crypto-method of crowdfunding has opened the floodgates to decentralized funding, which is helping support some amazing ideas that will no doubt change the world for the better.

However, such widespread success has also drawn the interest of malicious actors. Authoritarian governments are now considering centralized cryptocurrencies as a means to tap into international funding and skirt widely supported economic sanctions. These “authoritarian ICOs” inevitably support a myriad of human rights abuses and strategically subvert the naïveté of novice crypto-investors into a behavioral engine that seduces western consumers into bankrolling “startup funds” for maintaining power and eliminating dissent.

The Cryptocurrency of Hugo Chavez

The Venezuelan Petro is a tokenized, oil-backed digital currency. Denominated as “PTR,” the cryptocurrency is proudly touted as the realization of president Hugo Chavez’s idea of “a strong currency backed by raw materials.”

For those of you who aren’t already aware, Hugo Chavez was president of Venezuela from 1999 until his death in 2013, when he was succeeded by Nicolas Maduro. Chavez’s presidency was characterized by an alarming concentration of power and open disregard for basic human rights (HRW). During his term, Chavez:

- Took over the Supreme Court and prevented journalists, human rights defenders, and other Venezuelans from exercising their basic rights (HRW)

- Broadened media censorship policies as a measure to “democratize” the country’s airwaves (HRW)

- Withdrew from the American Convention on Human Rights, an international humans rights instrument for seeking redress when national courts fail to provide it (HRW)

- Nationalized (expropriated) the biggest Venezuela oil company (PDVSA), kicked out the majority of international oil companies, as well as nationalized many of the country’s main factories, companies, etc.

In recent years, Venezuela has consistently voted against UN General Assembly resolutions condemning human rights abuses in North Korea, Burma, Iran, and Syria (HRW). Chávez was also an outspoken supporter of Syria’s Bashar al-Assad, Libya’s Muammar Gaddafi, and Iran’s Mahmoud Ahmadinejad, and honored each of each of these leaders with Venezuela’s highest distinction, “Order of the Liberator” (HRW).

The Venezuelan Petro (PTR)

The Petro is described as “a sovereign crypto asset backed by oil assets and issued by the Venezuelan State.” This simply means that it is completely centralized and controlled by the government — a total antithesis to blockchain’s original thesis of a decentralized and disintermediated future.

“Petro will be an instrument for Venezuela’s economic stability and financial independence, coupled with an ambitious and global vision for the creation of a freer, more balanced and fairer international financial system…With Petro, Venezuela aspires to become the global leader of an economic initiative that makes it possible to take advantage of the value of its natural resources in an innovative way by developing and promoting the adoption of a cryptocurrency in the country.” — Petro White Paper

There is an anti-capitalistic tint to the language used in the white paper, which is understandable. Venezuela is one of many oil-rich nations that have been exploited by capitalist countries for natural resources. It makes sense that the Venezuelan government wants more control over their resources to maximize their own economic benefit. However, this theme of “economic sovereignty” is contradicted by the paper’s consistent mention of how international investors and stakeholders, not Venezuelan citizens, will benefit from this novel, cryptoeconomic system.

“…underpin the idea of Petro as an international currency developed and promoted by an emerging nation for the development of a decentralized, more egalitarian, inclusive and transparent global economy.” — Petro White Paper

In addition, the envisioned model for the Petro starts to seem exceedingly government-centric. The government — not the people it’s supposed to serve — is the primary beneficiary of the cryptoeconomic system. What the Venezuelan government is ultimately proposing, it seems, is a Venezuelan-controlled, oil-backed token, with very little explanation as to how the actual crypto-economic system (beyond the actual token) works. The Petro white paper contains minimal technical explanation as to how the proposed Petro cryptoeconomic system would work. Ambiguous, vague, overpromising — the paper has all the hallmarks of a fraudulent venture.

International Funding When It’s Convenient

Ironically, in 2010 Venezuela’s (corrupt) Supreme Court ruled that individuals or organizations receiving foreign funding could be prosecuted for “treason.” It was an effort to prevent foreign states from undermining Venezuelan democracy by supporting local (Venezuelan) NGOs (HRW). In fact, The National Assembly passed legislation prohibiting organizations that “defend political rights” or “monitor the performance of public bodies” from receiving international funding (HRW).

The Petro Token Sale itself is arguably in violation of these laws. In fact, Venezuela’s National Assembly has recently declared the Petro as illegal, with legislator Jorge Millan condemning the cryptocurrency as a way to mortgage the nation’s oil reserves (CryptoSlate):

“This is not a cryptocurrency, this is a forward sale of Venezuelan oil, It is tailor-made for corruption.” — Jorge Millan

This governmental conflict of interest exposes the criminal hypocrisy of Venezuela’s leadership: they turn to the international community only to fund extreme censorship, but they would never support a token project that facilitates an international revolution.

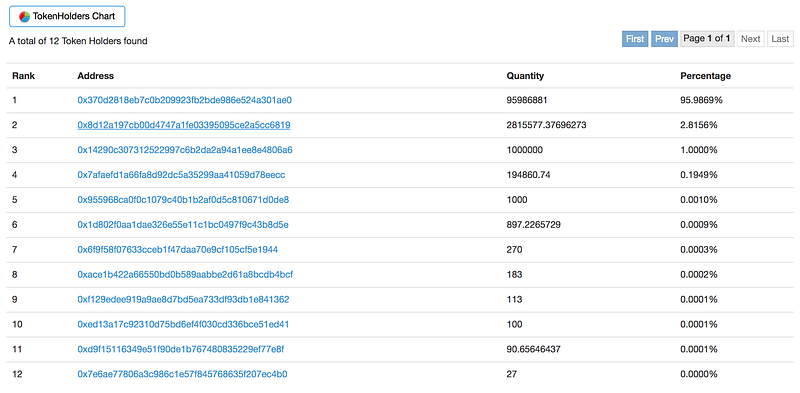

Crowdfunding Oppression Between Sanctions and Sales

The President of Venezuela, Nicolas Maduro, claimed that the first day of the PTR pre-sale generated over $730 million alone, but, at that time, there was only 4.2M token transacted, which would mean buyers accepted a price point of $173.80 per token — the highest token pre-sale price point recorded in history. Since PTR, originally, was an ERC20 token (based on Ethereum), we can rely on Etherscan, an Ethreum blockchain transaction explorer, to report the true story of transaction volume. What we find is that 95% of PTR transacted is owned by an address different than the original smart contract address, totaling $5.7 billion in holding at the proclaimed, white paper PTR price of $60 per token.

What’s odd is that the Petro is described in its white paper as an Ethereum-based ERC20 token but was reported to have abruptly switched to NEM Mosaics (CryptoSlate), essentially making the history of the entire token sale (as a whole) untraceable. NEM has since released a public statementconfirming that the Venezuelan government is intending to use the NEM blockchain but the platform itself is not involved (CryptoSlate).

There are only 12 token holders of the original ERC20 token (shown below), and there is currently no explanation for the presence of these tokens on the Ethereum blockchain other than the fact that they were intended for use in the pre-sale but have since been discarded in favor of NEM (CryptoSlate).

The NEM blockchain, however, reveals that somebody — perhaps the Venezuelan government — has created a NEM address that contains 100 million “Petro”. This address holds 38,400,000 tokens — the exact amount specified as for sale during the presale.

“If Maduro has already secured $735 million during the first 24 hours of the Petro presale, why does the Venezuelan government apparently control 100% of the Petro in existence? Occam’s razor dictates that no such sales have occurred.” — Sam Town, CryptoSlate

A western world filled with misinformed and proud, self-acclaimed “crypto-investors” makes for an incredibly easy market to scam, by hustlers and governments alike. Those of us who have been in the cryptocommunity for some time (5+ years), have seen scams happen many times. But the flood of token sales in 2017 opened up Pandora’s box and revealed just how much capital could be stolen at a time.

Now we’re seeing fraudulent operations like BitConnect (currently under mass prosecution) boast a market cap of over $2.6 billion at a max value, exceeding $400 per token. The Venezuelan government hopes to raise more than double that amount, approximately $6 billion, with their initially set price of $60/token over a 100 million token volume.

The potential of raising this amount of capital empowers the Venezuelan government to fiscally raise their middle fingers to the ongoing economic sanctions imposed on the country — enabling it to crowdfund its human rights abuse expenses while Venezuelan citizens bear the economic hardship of levied international sanctions. Economic sanctions are ostensibly intended to raise costs for the military and are expected to somehow spur a rebellion against Maduro, but extensive academic research has shown that economic sanctions are rarely effective (Rodriguéz). By contrast, the sanctions against Venezuela have backed the regime into a corner, increasing the costs that the government would face upon leaving power and raising the incentives for Maduro to dig in his heels (Rodriguéz).

Starving the Venezuelan economy of its foreign currency earnings risks turning the country’s current humanitarian crisis into a full-blown humanitarian catastrophe. An unchecked Petro token sale would be a potential deathblow, ultimately bankrolling the government’s ability to continually erode the surviving remnants of true Venezuelan democracy.

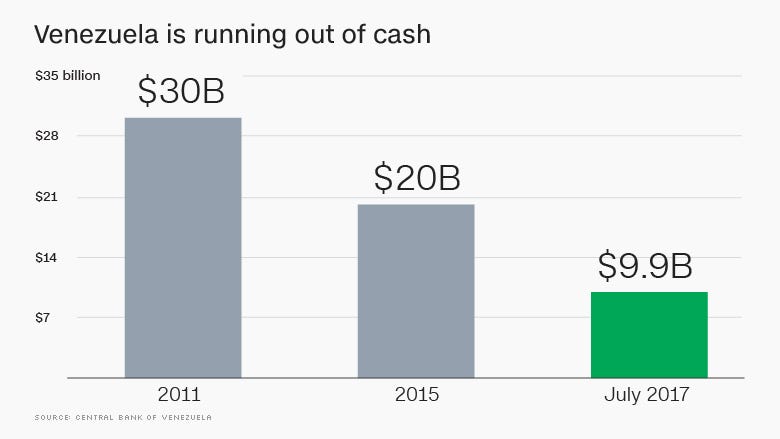

A Token Sale that Could Double the Nation’s Cash

The Petro white paper parades the cryptocurrency as a viable asset that could be leveraged by the average Venezuelan, but the only thing Venezuela has in abundance right now is chaos.

As one of the world’s leading oil producers, Venezuela used to be the richest country in South America. However, oil has since then plunged in value, decreasing 50% from 2014 to 2016 ($100/barrel to $50/barrel). This evaporation of wealth has cut the nation’s income in half (CNN).

With oil prices low and the government’s cash dwindling, price controls have become a huge problem (CNN). The state still subsidizes food far below normal prices to appease the poor (CNN). Maduro has printed money at breakneck speed, and the bolivar has plunged in value, wiping out jobs and income (CNN). The latter is causing extraordinary hyperinflation of the Bolivar/USD pair. In 2010, $1 USD was worth about 8 bolivars. Today, it’s worth over 8,000 bolivars (CNN).

As prices hyper-inflate, the Venezuelan government is still obligated to pay its national debts to China and Russia instead of buying food and medicine from abroad. The result: starving Venezuelans and soaring deaths in hospitals. Food shortages are so severe that the average Venezuelan living in extreme poverty lost 19 pounds last year, according to a national poll.

Looking at the country’s economic circumstances, and its authoritarian governance, it is more than likely that all proceeds from a $6 billion token sale would fund the government’s existing debts, while fortifying the Maduro regime to maintain power. Of course, to a LinkedIn-proclaimed “ICO Advisor” or “Blockchain Investor,” the ERC20, face-value Petro token is one “heck of a deal.”

Abusing the Blockchain

Blockchain technology and cryptocurrency are naturally amoral. The humans that architect and transact value on top of these systems are the ones that inject purpose. Whether that purpose is virtuous or iniquitous is the question. Participants within these systems can succumb to and perpetuate dangerous agendas if they aren’t vigilant and informed. In the case of Venezuela’s Petro, market participants are not just bystanders but active contributors to and co-conspirators of injustice.

It is the responsibility of every member of the blockchain community at large to flag and decry fraudulent and exploitative uses of cryptocurrency. The wonder of blockchain technology is that it breaks down the boundaries between countries and between the developing and modern world. This immediate and seamless global reach might sometimes blind us to the more involved geopolitical conditions on the ground. When a government announces a token launch, we should pay close attention to the way that a new cryptoeconomic model fits into the larger story of that nation, and whether it will actually support citizens or cut them off.

The promise of blockchain? The peril? That’s for all of us to decide.

see source